Personal Financial Statement Template

Creating and maintaining your own Personal Financial Statement is useful for 4 main purposes: (1) Gaining a good financial education, (2) Creating and evaluating your budget, (3) Applying for business loans, and (4) Applying for personal loans.

If you already know why you need one, and why you want to use Excel to create one, then go ahead and download the template below. If you'd like to learn more about it, continue reading this page.

Personal Financial Statement

License : Personal Use (not for distribution or resale)

Author : Jon Wittwer

If you would like to use this Personal Financial Statement in your business to assist your clients, you may purchase the commercial-use version.

Return Policy : 60 Days

License : Commercial Use

Description

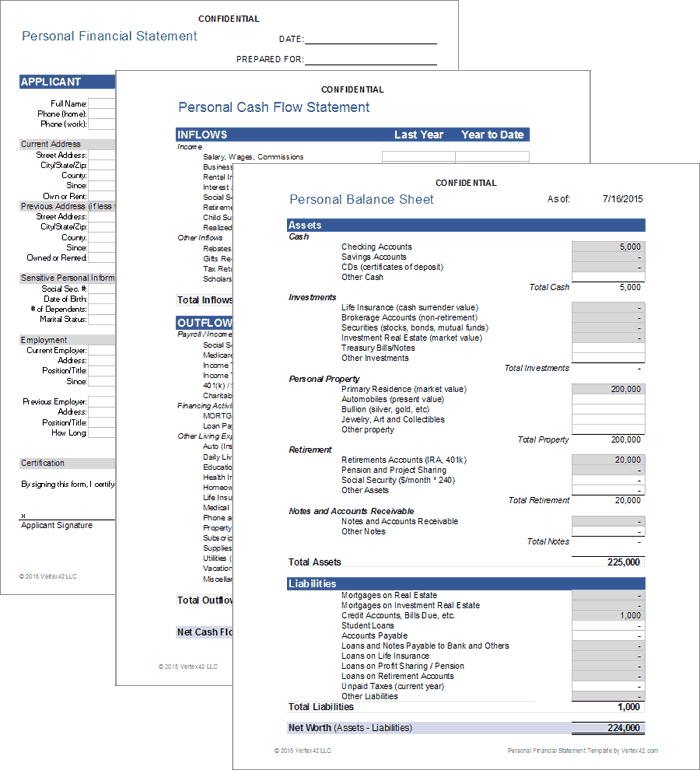

- Personal Balance Sheet - for listing assets and liabilities and calculating net worth.

- Cash Flow Statement - for listing all your inflows and outflows and calculating your net cash flow.

- Details Worksheet - for listing individual account balances and the details for your properties and loans.

- Info Sheet - for listing contact info that is typically required in loan applications (e.g. names and addresses of the applicant and co-applicant).

It also includes calculations for some common financial ratios:

- Basic Liquidity (BLR) Ratio = Total Liquid Assets / Total Living Expenses :: How many months can you live on your liquid assets without any income? This ratio uses info from both the balance sheet and the cash flow statement. It's one of the really cool things that your PFS can tell you.

- Debt-to-Income (DTI) Ratio = Annual Debt Payments / Annual Income :: A ratio commonly used by lenders to determine how risky of an investment you will be. It should be below about 35% to be considered to have an acceptable level of debt. This comes from the cash flow statement.

- Debts-to-Assets Ratio = Total Liabilities / Total Assets :: Indicates the degree of leverage that is used by a person or company to finance their assets. The higher this ratio the less financial flexibility you have. This comes from the balance sheet.

Why is a PFS useful for creating and evaluating a budget?

If you have already created and follow a budget, your PFS is basically half done. A personal cash flow statement is almost exactly the same thing as a budget, except that a budget is a plan or projection, and your cash flow statement lists your actual earnings and expenses.

A cash flow statement helps you create your budget. Your budget helps you plan how you are going to allocate your net cash flow (hoping of course that your net cash flow is positive).

Why does a PFS help you increase your financial education?

Did you already know the relationship between a cash flow statement and a budget? It's not that the PFS is going to teach you directly. The point is that to accurately complete your personal financial statement you are going to need to ask a lot of questions, and probably do a lot of Google searching, to figure out why such-and-such is a liability, or what exactly is an asset, etc.

Using the template will give you a big head start, but don't assume that everything I've included in the spreadsheet is 100% correct or that it is organized optimally for your needs. Use it as a template - it is just a framework to help you get started. Verify all formulas and make sure you understand exactly how things are calculated.

Why is a PFS used in applying for loans?

A lender needs to evaluate the risk of lending money to you. One of the ways they do that is by analyzing your income and how much debt you currently have. They can get that information from your personal financial statement.

If you are applying for loans, banks will likely have their own personal financial statement (PFS) forms for you to fill out (I've linked to a couple in the references at the bottom of this page). But, if you are already maintaining your own PFS in Excel, then that will make the process MUCH easier.

The Personal Balance Sheet

Step 1: list all your assets.

An asset is something that you own that has exchange value. You may really love your pet rock, but it's probably not an asset. Your financial assets are your cash, savings, checking account balances, real estate, pensions, etc.

Watch out for the cells that are highlighted gray. These are values that come from the Details worksheet. If you overwrite the formula, you'll need to fix it.

Click on the links labeled "Schedule 1" or "Schedule 2" to go directly to the spot on the Details worksheet for entering those assets.

Step 2: List all your Liabilities

Liabilities are your debts and other unpaid financial obligations. Future expenses such as fuel for your car are not liabilities, but unpaid bills are.

Step 3: Calculate Net Worth = Assets - Liabilities

The full market value of your home is an Asset . The amount you still owe on the mortgage is a Liability . The difference is what you call call Home Equity . In a typical business balance sheet, the terms Owner's Equity or Shareholders Equity are the same as Net Worth : Owner's Equity = Assets - Liabilities.

The Personal Cash Flow Statement

Step 1: list all your inflows.

Inflows include all sources of income (wages, dividends, etc.) and whatever else puts money in your pocket.

The Inflows are grouped into "Income" and "Other Inflows", because some financial ratios are based on "Income" and not all inflows are necessarily considered income (such as tax returns, reimbursements, or gifts). You'll need to decide what should be considered income, perhaps by consulting with your accountant.

If your home or stocks increase in value, there is no cash inflow until you sell them. So, realized capital gains (the profits from the sale of property) are inflows, but unrealized capital gains (the gain in value of unsold property) are not.

Step 2: List all your Outflows

Categorizing your outflows is important if you want to calculate certain financial ratios. For example, the "Payroll Deductions" category consists of things deducted from your paycheck. The net income used by the Debt Service Ratio is your gross income minus these deductions.

Why aren't insurance premiums listed under payroll deductions? You can list them there if you want to. But, if you didn't have any income, you would still want to have health insurance, so I find that including health insurance under living expenses is more convenient for calculating the "Total Living Expenses" used by the BLR ratio.

The "Financing Activities" category of outflows is used to determine your total debt payments. That total is used by the debt-to-income ratios. For these ratios, the mortgage payment includes the escrow payment (property tax and insurance) in addition to interest and principal.

Step 3: Calculate Net Cash Flow = Outflows - Inflows

One of the first things you need to learn about personal finance is how to calculate your net cash flow. That is simply the sum of all your inflows (wages, investment income, gifts, and whatever else puts money in your pocket) minus the sum of your outflows (everything that takes money out of your pocket).

References and Resources

- SBA PFS Form (PDF) at www.sba.gov - This is an example PFS used when applying for an Small Business Association (SBA) loan.

- Cash Flow and Budgets at utah.edu - Explains how the cash flow statement and budget are related.

- SCORE PFS (Excel) at www.score.org - This is a fairly simple personal financial statement template for Excel, including only the balance sheet and details for assets and liabilities.

Follow Us On ...

Related Templates

Financial Statements

17 Personal Financial Statement Templates and Forms (Word, Excel, PDF)

The personal financial statement is a document featuring an individual financial state at a specific time. Suppose you want to secure your investment or take a loan. Investors or financial institutions usually require this form or spreadsheet. In addition, it values some assets and contains income details, such as life insurance, mutual funds, annuities, bonds, and your stock financial worth.

At the bottom of this form, you will find a sum of all assets provided. However, as much as the total value of the entire asset is offered, you must understand that not all the listed assets are accessible. And If you are not well familiarized with this spreadsheet, worry less because this comprehensive post has you covered.

What is a Personal Financial Statement?

A personal financial statement is a form that most people use to evaluate their financial status closely and is the same as a credit report. Furthermore, you can utilize this statement to determine a party’s financial stability or creditworthiness . With this statement, you can quickly get a loan or finance approval, like a mortgage, credit card, and auto loan.

What Is a Personal Financial Statement Template?

A personal financial statement template is a document containing your financial status at a specific duration. Besides, it lists all your net worth, liabilities, and assets.

Personal Financial Statement Templates & Examples

Who Needs a Personal Financial Statement?

This statement can be used by any individual who needs to understand their financial health. In most cases, aspiring entrepreneurs usually use it to try and win over the investor or acquire a loan.

Essential Elements of a Personal Financial Statement Template

There are several elements of a personal financial statement template. They include:

A balance sheet

You can also call it the financial position statement. It contains all your liabilities and assets. Similarly, you can use it to calculate the net worth by deducting your liabilities number from your assets number. For instance, if your assets are worth $80,000 and your liabilities are worth$45,000 , your net worth will be $35,000 . This element needs you to conduct sufficient research to correctly accomplish this portion of the financial statement since your valuable property needs to be appraised. Likewise, you must also have your credit report to confirm the status of the entire unpaid debt.

Personal information

Here you must provide any information you would love to share, telephone number, address, and your full legal name. Bear in mind that personal data is usually used to find out the owner of the personal financial statement. Suppose you are an entrepreneur who needs either an investment or a loan. You might also love to include your business name.

Personal Financial Statement VS. Other Financial Statements

When your business progresses and runs adequately, it offers you sufficient entity to all your financial statements. Additionally, a business entity that is well established features its liabilities and assets, hence giving you more than enough history to develop the profit and loss (P&L) statement.

On the other hand, if you are commencing your business from scratch with no financial history and have nothing to base your statement on. Creditors and investors will only base on the entrepreneur’s financial integrity. This will go on for a while until the business experience sufficient success to gain its financial identity. During this all time, you will be providing your personal financial statements.

How to Prepare a Personal Financial Statement?

Below are some steps that will guide you on how to prepare a personal financial statement:

Step 1- Develop a spreadsheet with a section for assets and another section for liabilities

You can start by listing your liabilities, assets, or vice versa. After this, you will require another section on your spreadsheet to show how you calculated your net worth.

Step 2- List the assets as well as their worth

Any asset you list is not appraised as an asset unless it is yours. Furthermore, assets do not include a rented apartment or home and less or minor valued items. Without further ado, common assets entail retirement accounts balance, the value of annuities or stocks, savings and checking account balance, gas and oil rights. It also includes riparian rights, mineral rights, owned real estates, and more valuable assets, like rare coins and fine art. Ensure that as you list, each asset has its cell. In the next cell next to the mentioned asset, indicate the asset’s value in dollars.

Step 3- List each liability and its worth

A liability includes anything that you owe money. Examples of liability include unpaid federal taxes or state, facing court judgments, or minimal claims, credit card balances, personal loans balances. Ensure you name every liability, and in the next cell where you have listed the liabilities, state the balance.

Step 4- Determine the sum of both liabilities and assets

Suppose you are using Excel. You must highlight a row listing the dollar value of every asset and utilize a total formula. Apply the same procedure to liabilities with the total liability indicated directly under their corresponding category. For instance, the total liabilities might be $250,000 while the total assets are $515,000.

Step 5- Determine the net worth

It would help if you created the net worth total cell to calculate your net worth. In the next cell, after the net worth total cell, deduct the sum amount of liabilities from the total assets. For instance, using the example mentioned in the previous step above, your net worth will be $265,000.

Remember, you can also include your sources of income. However, this depends on why you came up with the personal financial statement. In most cases, you can include your income in the information if you are applying for a loan, and it can act as a personal guarantee for your loan.

Legal Considerations

The personal financial statement entails several legal considerations compared to a corporate document or form. Since this document should create an accurate image of the financial status, you need to take the entire process seriously, just as you take other legal documents seriously. Make sure that your personal financial statement includes your personal property , rented items, and business-related liabilities and assets

Personal financial statements and audits

Auditing can only happen if the court or IRS asks for your financial documents since they do not find you trustworthy about your financial status. The auditing process can be pretty stressful because you might need to hire an accountant or attorney to help you out, which can be an additional cost on your end. Remember, financial dishonesty can make you face criminal or civil charges, resulting in jail terms or fines. Furthermore, IRS or the court can order you to stop all your businesses.

So, what number of personal financial statements do you need?

Statistics from the small business administration guidelines state that personal financial statements need to be accomplished by each loan guarantor. Besides each stockholder featuring around 20% of voting stock and each limited partner with 20% or a large percentage of the business, every general partner and the proprietor must complete the personal financial statement. Creating a personal financial statement for the parties mentioned above might seem hectic, but it can be quick if you use a simple financial statement that features a similar format.

Can I prepare my financial statements?

Due to the advanced technology, you can use computer software to prepare your financial statements. However, if you are preparing for a third party, like bankers, they might request that their financial statement be created by a certified public accountant or a professional accountant.

What are the two types of personal financial statements?

The two types of the personal financial statement include:

- A personal balance sheet

- A personal cash flow statement

What are the main purposes of personal financial statements?

There are several purposes of financial statements. They include:

- Offering information about financial status within a specific time

- Generate data that you can utilize to apply for credit or prepare your tax forms

- To keep you updated on the financial activities

- It determines your development towards your entire financial goals

- Reports the current financial position, which must entail your assets and liabilities

Final Thoughts

This article has given you a great insight into the personal financial template. Therefore, if you want a business loan, ensure you create one to receive approval. You must share your personal financial status with your financing source. In addition, the financing source may proceed to assess your financial health to see how well you control your funds. Before you opt to borrow a loan, ensure that you create your financial statement.

How did our templates helped you today?

Opps what went wrong, related posts.

23+ Business Travel Itinerary Templates

Apology Letter For Bad Behavior – 7+ Samples & Formats

Restaurant Employee Evaluation Form

Peer Evaluation Form: Templates and Examples

Free Newspaper Templates

40 Free Event Program Templates

44 Open House Sign in Sheet Templates

22+ Free Packing Slip Templates

Thank you for your feedback.

IMAGES

COMMENTS

Nov 9, 2024 · A personal financial statement is a document summarizing a person's financial standing. It provides a full list of their personal assets and liabilities as well as their income and expenses. Commonly required by financial institutions when applying for credit or a loan, it demonstrates a person's creditworthiness and repayment ability.

Oct 8, 2020 · In a typical business balance sheet, the terms Owner's Equity or Shareholders Equity are the same as Net Worth: Owner's Equity = Assets - Liabilities. The Personal Cash Flow Statement Step 1: List all your Inflows. Inflows include all sources of income (wages, dividends, etc.) and whatever else puts money in your pocket.

List all of your liabilities and assets; After gathering all of your financial documents, you can either use an online template, a paper and pen, or an Excel sheet to make a list of all your liabilities and assets. Use two columns and jot down the value of each item so that you can get the sum totals for each column.

Examples of liability include unpaid federal taxes or state, facing court judgments, or minimal claims, credit card balances, personal loans balances. Ensure you name every liability, and in the next cell where you have listed the liabilities, state the balance. Step 4- Determine the sum of both liabilities and assets. Suppose you are using Excel.

This personal financial statement template is a great tool to keep track your personal assets, liabilities, income and expenses. A personal financial statement is a document or set of documents that outline an individual’s financial position at a given point in time. It is usually composed of two sections: a balance sh

A personal financial statement is a document that provides a snapshot of an individual’s financial position at a given point in time. It typically includes information on an individual’s assets, liabilities, and net worth. Assets are items or properties owned by the individual, such as cash, investments, real estate, and personal property.